**update** 05-22-2013 Here is a copy of the proposed budget:

Update #1: I have added a copy of last year's budget message for comparison's sake at the end of this article.

Update #2: Here is a searchable text of the current budget message...

Macon County Manager's Office • Budget Message

Macon County Board of Commissioners

Chairman: Kevin Corbin

Vice-Chair: : Ronnie Beale

Commissioner: Ron Haven

Commissioner: Paul Higdon

Commissioner: Jimmy Tate

Gentlemen,

In accordance with the North Carolina Local Government Budget and Fiscal Control Act, I am pleased to present to you the proposed budget for Macon County for Fiscal Year 2013-2014.

Macon County continues to maintain a solid financial position compared with many counties in North Carolina. The county currently has the lowest ad-valorem property tax rate among all 100 counties in North Carolina (@ 27.9 cents per $100) , and our fund balance remains healthy. This continues to provide a high degree of financial security in terms of being prepared for unexpected emergencies or shortfalls in revenue. The healthy fund balance, a conservative approach to budgeting, along with a consistent tax collection rate contributes to Macon County’s A+ Bond Rating.

The past year has been remarkable for Macon County in terms of positive accomplishments, especially in an era of economic distress throughout our state and nation. We are very pleased that the record will show the county has been vigilant in its approach to responsible financial planning while making needed improvements and investments in the future of all our citizens. I sincerely believe this is what is expected in order to be good stewards of the public trust. I will take time in this budget message to emphasize both highlights of the current year, and the challenges facing the county next year.

- This past year we have seen the completion of the new K-4 Iotla Valley Elementary School. The school opened on time and under budget at a cost of ($11,300,000) or $118.00 per square foot, and was financed with Qualified School Construction Bonds (QSCB) at a net interest rate of .48% for a term of 17 years

- Replacement windows were installed in the newly renovated Nantahala School with savings from the $1,800,000 renovation that was completed last year.

- Construction renovation ($1,5000,000) has begun on the Highlands K-12 School with completion hopefully by August 26th.This project is being funded by the county using (QZAB) Qualified Zone Academy Bonds at a net interest of 0%.

- The county has coordinated the funding and administration of the Swiss Colony water project for the Town of Franklin. Total cost is $750,000 .The project will be completed this month. This was a part of the original Highway 28 North, Riverbend water project of $1,800,000. The entire system will be transferred to the Town Of Franklin for maintenance and operation.

- Macon County funded a 10% match ($200,000) for the $ 2,000,000 Macon County Airport Apron renewal project which is now complete. The Airport is in line now for additional FAA funding for the next fiscal year for a project to widen the runway.

- We have completed the renovation of the new Sheriff’s Office on Palmer Street along with a new DMV Drivers License Office at the same location.

- The Barrett building renovation is complete including a state of the art Emergency Communications Center and elevator service to all three floors.

- With the priority of keeping our public safety equipment up to date, this year we purchased 6 new patrol vehicles for the Sheriff’s Department, 2 new Ambulances and 12 new defibrillator/monitor machines for each of our ambulances in the Emergency Medical Services Department. We also added an Autopluse machine for each base in EMS.

- Thanks to the efforts of our Finance Director and BB&T, we were able to refinance long term existing debt for the county saving over $2,700,000 in interest charges.

- We were able to provide $1,500,000 to the Macon County Public School System that enabled them to upgrade all their current Information Technology equipment.

- We renovated the Pool House and the Swimming Pool at the Macon County Recreation Parkmaking it a safe, modern, and family friendly facility. It opens this month.

- The county was able to purchase a 48 acre tract of land known as Parker Meadows, which in time will be developed into a state of the art ball park and recreation facility containing 8 softball/ baseball fields along with other amenities

- Our Economic Development efforts are paying off with increased activity in the Business Development Center with new prospects for job creation. We were extremely fortunate to be able help Tri Corn International acquire and establish a new business here (Franklin Tubular Products) to replace Whitley Products. Our EDC Director, the Economic Development Commission, and both the Town of Franklin and Macon County contributed to making this a success.

- Our new Macon County Health Department Dental Clinic is now up and running and we are completing the long awaited renovation of the Holly Springs Community Development Building this month.

We started the budget process this year with a mid-year retreat/work session with the Board of Commissioners. It was the consensus of the Board at that time that we would construct a budget without an adjustment to the property tax rate. This proposed budget meets that objective.

After discussing possible goals and objectives for the coming year a budget schedule was presented, and we have tried to stay with that timetable as closely as possible. It is as follows:

FY 2013/2014 BUDGET CALENDAR

Feb. 15, 2013 at 8:30 a.m. . . . . . . . . . . . . . . . Preliminary Budget Meeting with Department Heads

March 15, 2013. . . . . . . . . . . . . . . Departments complete line item budget input and return hard copy requests and narratives.

March 25, 2013. . . . . . . . . . . . . . . Print line item budget report for County Manager review.

April 1 - April 12, 2013. . . . . . . . . . . . . . . County Manager meetings with department heads

April 15, 2013. . . . . . . . . . . . . . . Macon County Schools and outside agencies submit budget requests.

May 14, 2013. . . . . . . . . . . . . . . Manager’s recommended budget presented to BOCC with message; distributed to department heads, posted on County webpage.

May 15, 2013 until. . . . . . . . . . . . . . . Work Sessions with Board

June 11, 2013 at 6:00 p.m. . . . . . . . . . . . . . . Public hearing on the budget

June 18, 2013 at 6:00 p.m. . . . . . . . . . . . . . . Board adopts budget

- Property tax- collections of current year and prior year unit-wide tax levies; interest on delinquent taxes; late listing penalties; and other costs of collecting delinquent taxes.

- Other Tax- collections of taxes from special tax districts; animal taxes; deed stamp excise taxes; real property transfer taxes; scrap tire disposal taxes; local occupancy taxes; prepared food taxes; 911 charges; white goods disposal tax; and privilege and other license taxes.

- Sales Tax- collections of the one percent local option Sales Tax (Article 39) and the one-half of one percent local option Sales Taxes (Articles 40, 42,).

- Sales and Services- parking revenues; rents and royalties; airport revenues; fire protection charges; solid waste charges; ambulance and rescue squad charges; cemetery revenues; recreational service revenues; library service revenues; other cultural and recreational service revenues; client and third party payments for health, mental health, social services, and nursing home services; mass transit revenues; and water/sewer charges.

- Intergovernmental- federal, state, and local financial assistance including payments in lieu of taxes; equitable sharing of federally forfeited property; categorical grants; controlled substance taxes; distributions of beer and wine taxes; payments of court costs. Public School Building Capital Fund revenues; Public School Building Bond Fund revenues; and lottery receipts for school construction

- Miscellaneous- building permits; Register of Deeds’ fees; building inspection fees; other permits; investment earnings; special assessments; private contributions and donations; sales of materials, fixed assets, and real property; ABC Board bottle taxes; ABC Board profit distributions; proceeds of the sale of bonds and notes; proceeds of lease purchase agreements; and other Miscellaneous Revenues

- Education - appropriations to school administrative units and to community college systems for current operations and capital outlays

- Debt Service - principal, interest, and fees paid or accrued on debt.

- Human Services - expenditures for the public health, mental health, and social services programs; veterans’ service officers; legal aid; appropriations to hospital; county’s share of Medicaid payments, Work First expenses, and Special Assistance to Adults; county’s share paid to multi-county health district and an area mental health authority; and payments of the 5-cent ABC Board bottle tax.

- General Government - expenditures for the governing body, administration, elections, finance, revaluations, legal services, Register of Deeds, construction and maintenance of public buildings not related to other functions, court facilities, and net central services.

- Public Safety - expenditures for the sheriff’s department, jails, emergency communications, emergency management activities, fire protection, building inspections, rescue and ambulance services, animal control, and medical examiners or coroners.

- Other - expenditures for transportation, solid waste, drainage and watershed, cemeteries, planning and zoning, economic and community development, agriculture extension programs, special employment programs, culture and recreation, water and sewer, unallocated fringe benefits, and miscellaneous expenditures.

Fund balance "available" is the statutory concept that describes the amount of funds local governments legally have available to be appropriated in the coming fiscal year. It is essential that ad valorem tax-levying units, such as municipalities and counties, maintain an adequate amount of fund balance available to meet their cash flow needs during the months in their revenue cycles when outflows exceed inflows. This ensures that the unit can meet current obligations and to prevent the unit from experiencing cash flow difficulties.

The Local Government Commission policy requires that, on June 30, units maintain a minimum balance of 8 percent of the prior year’s expenditures, or approximately one month of expenditures.

North Carolina counties have historically maintained fund balance available levels well above the 8 percent minimum as a cushion against unexpected expenditures, emergencies or declines in revenues. Bond rating agencies reinforce the notion that fund balance should be above 8 percent and that higher levels are required for sound financial management. The higher balance is often necessary because the available fund balance many times includes restricted amounts, such as sales tax that is restricted for school capital outlay and funds set aside for debt service.

Using the 8 percent fund balance metric as a target, rather than an absolute minimum, may have devastating effects on the fiscal health of North Carolina counties. Across the state, the average fund balance amounts maintained by counties have been fairly consistent throughout the recent economic downturn. Counties have responded to the current economic downturn by reducing their budgets to avoid depleting fund balance available. Many counties have reduced expenditures through layoffs, furloughs, and service reductions. In addition, some counties have had to raise taxes and fees to maintain their financial stability. Their boards have made the difficult choices to maintain the good fiscal health that North Carolina local governments seek to achieve. Maintaining a strong fund balance is the prudent course for counties especially during these uncertain economic times. Depleting the fund balance could result in the county being forced to raise property taxes in order to meet essential and vital needs of our citizens.

- Tax Assessment: Work is underway now in the property revaluation process. It must be completed and on the books by January 2015. Much of this work will be accomplished during the next fiscal year 2013/2014.

- Beginning July 1st this year there will be a new process in place by the NC Department of Motor Vehicles. Vehicles subject to property tax (city and county) will be paid at the time of License Plate renewal. This will obviously take some time to adjust to. The net effect will be that eventually local governments will collect 100% of property taxes due on motor vehicles. Our collection rate now is below 90%.

- In regard to Information Technology, the proposed budget reflects our need to expand capabilities to retrieve and retain additional data associated with all county departments. This means we must continue to invest in new hardware and software accordingly.

- Public Safety continues to be a top priority in the county budget with the acquisition next year of two new ambulances for our EMS Service, and five new patrol vehicles for the Sheriff’s Department.

- There are no new county positions included in the proposed budget. We have allowed for funds in the Schools Capital Outlay budget for improvements related to school safety. We had 16 new positions requested in the budget process by multiple departments, but none have been included in the proposed budget due to limited resources.

- We have been notified that the Macon County Airport Authority has been approved for additional FAA and state funding of approximately $2,900,000 and will require a 10% local match. When that is made official it will be brought to the Board of Commissioners for consideration. It is not reflected in the proposed budget.

- The Cowee School Project has been separated from the Economic Development budget to better identify the expenditures related to that project. The budget does include a new heating and cooling system for the building. The new system will reduce energy cost and pay back can be realized in two to three years depending on the rising cost of fuel oil.

- Our Transit budget for Elderly and Handicapped Transportation has been included in the Transit Department’s operations budget for the coming year.

- Soil Conservation Service includes a grant from Duke Energy, $37,050

- The Health Department budget includes the Regional Transformational Grant of $570,000. This is pass though money and will not have a permanent effect on the regular Health Department budget.

- There is a small contribution to the Community Care Clinic. The original request was for $50,000 but due to limited resources it has been recommended to begin at $10,000.

- The Department of Social Services budget contains $1,460,276 in pass through funds from the state for Day Care payments to providers in Macon County. This is neither revenue nor expenditure in terms of county funding. It inflates the DSS budget arbitrarily, as this was originally paid directly by the state.

- It should be pointed out that the grants for Health and Social Services account for over 2 million ($2,000,000) in the budget. Without the Transformation Grant and the pass through of Day Care payments from the state, our overall budget would be considerably smaller.

- The Fontana Regional Library system that operates the Macon County and Hudson Libraries is budgeted for an increase of a 3.15% for the coming year.

- In addition to the regular annual appropriation for recreation for the Town of Highlands($495,000), the budget reflects an additional $250,000 which represents a joint effort between the town and the county for the Swimming Pool replacement project scheduled for later this year.

New Intermediate School and expansion to East Franklin..................... $20,000,000

Purchase (Owens) property for Mountain View Intermediate..................$2,600,000

Nantahala Renovation (QZAB)....................................................................$1,800,000

Iotla Valley Elementary School Construction...........................................$13,869,000

Franklin High School Improvements...........................................................$1,321,000

Highlands School Improvements and sports fields........................................$938,000

Information Technology for the entire School System...............................$1,500,000

Highlands School Renovation.......................................................................$1,500,000

____________________________________________________________________

Total County Funded School Capital Projects since 2008.......................$45,528,000

Macon County Schools County Funding

For Current Expense and Debt Service

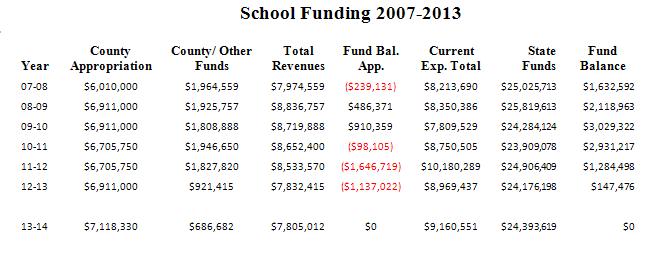

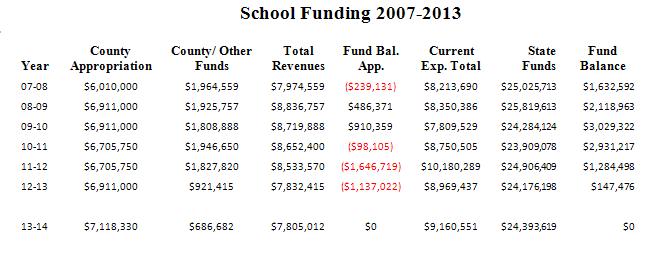

Our local school system is facing a crisis in terms of current operational expense. The primary responsibility counties have is to provide adequate school facilities and the primary responsibility for the state is to fund operational expenses. Over the past couple of years the school system has tried to maintain an operational level created by stimulus funding and erratic state funding. This year’s county funding recommendation is as follows: A 3% increase in Current Expense with a Capital Outlay appropriation of $199,035.

FY 13-14 Current Exp - CO-Solid Waste - Supplement...............$7,819,986

Public School Debt Service - ..................................................... $5,660,676

FY 2014 Total Macon County General Fund Budget................ $46,643,716

School Funding as Percent of General Fund.............................. 28.90%

County Property Taxes ..........................................................$25,394,671

Appropriation as a Percent of Property Taxes........................... 53.08%

Without a reduction in expenses, a revenue shortfall of $1,355,539 will occur next year. A property tax increase of 1.5 cents per hundred dollars valuation would be required to generate this amount of revenue.

Challenges for the Coming Year

Without a reduction in expenses, a revenue shortfall of $1,355,539 will occur next year. A property tax increase of 1.5 cents per hundred dollars valuation would be required to generate this amount of revenue.

Challenges for the Coming Year

In order to fund essential county services, meet the county’s debt service obligation on capital projects, and maintain critical needs in education and public safety, we have made decisions and recommendations that prioritize ,and in many cases reduce departmental and agency budget requests this year. There are many worthwhile and commendable projects, programs, and services that have merit and still need to be funded and or implemented, but have not been included in this proposal due to lack of additional revenue.

The original approved general fund budget for this year (2012/2013) was $44,391,193. Due to continuing contracts, grants, and additional revenue the current revised budget for this year is$48,007,997. The proposed general fund budget for fiscal year (2013/2014) is $46,643,716.

The county General Fund operating budget is balanced within existing revenues. The goal set by the Board in January was to create a balanced budget without a tax increase. No property tax increase is requested or reflected in this proposed budget. We have reduced requests for capital outlay and trimmed other expenses where feasible. Our goal over the past five years has been to maintain the current level of service without additional staff. We have been able to do that by leaving non critical positions unfilled throughout county departments. We continue to fill only essential positions when they become vacant. Our county employees have worked hard to do their job as they continue to help us hold the line on spending while delivering essential county services. Macon County is indeed fortunate to have such dedicated and devoted employees. The Board earlier this year implemented the new classification and pay plan. Your county employees are very grateful for the Board’s action in bringing our entry level salaries up to minimum recruitment levels and adjusting fair compensation based on the market rate.

Our self funded health insurance program continues to remain strong. We have not increased our rates for employee/dependant coverage in several years due to the fact our claims experience has been favorable. We are not proposing an increase in employee contributions at this time. To do this would sacrifice Macon County’s grandfather status and result in total higher cost for coverage because of tenants of the Affordable Care Act. This will be needing review by January 2014 and adjustments can be considered at that time as a result of full implementation of the Federal Governments Affordable Care Act.

Every year, Macon County strives to improve facilities, provide and maintain services, while we recruit and retain qualified employees. Our goal continues to be improving quality service for citizens and visitors alike. We are committed to maintaining the county’s leadership position in Western North Carolina. Macon County has a reputation of being a forward thinking progressive county that seeks to improve the quality of life while carefully balancing the needs of our citizens and the tax burden they are asked to bear. I believe this proposed county budget reflects that commitment.

A full and complete line item detail has been prepared that gives a thorough breakdown of each expenditure, appropriation and revenue source.

The state is still facing another budget crisis. With the General Assembly still in session we remain concerned that the state could shift additional responsibilities and/or reduce county funding to correct its budget situation. We hope that will not be the case. We have been reassured by our legislators that the state will not balance their budget on the backs of the counties this year. They seem to be trying to hold to that pledge. I remain somewhat optimistic.

Funding for outside agencies in the Special Appropriations budget remains at current year levels.

The proposed budget for Macon County for Fiscal Year 2013 / 2014 as required by state statute is balanced with revenues and expenditures of $46,643,716 and is hereby submitted for your review and consideration.

Respectfully,

C. Jack Horton

County Manager/ Budget Officer

For Current Expense and Debt Service

FY 13-14 Current Exp - CO-Solid Waste - Supplement...............$7,819,986

Public School Debt Service - ..................................................... $5,660,676

FY 2014 Total Macon County General Fund Budget................ $46,643,716

School Funding as Percent of General Fund.............................. 28.90%

County Property Taxes ..........................................................$25,394,671

Appropriation as a Percent of Property Taxes........................... 53.08%

The original approved general fund budget for this year (2012/2013) was $44,391,193. Due to continuing contracts, grants, and additional revenue the current revised budget for this year is$48,007,997. The proposed general fund budget for fiscal year (2013/2014) is $46,643,716.

The county General Fund operating budget is balanced within existing revenues. The goal set by the Board in January was to create a balanced budget without a tax increase. No property tax increase is requested or reflected in this proposed budget. We have reduced requests for capital outlay and trimmed other expenses where feasible. Our goal over the past five years has been to maintain the current level of service without additional staff. We have been able to do that by leaving non critical positions unfilled throughout county departments. We continue to fill only essential positions when they become vacant. Our county employees have worked hard to do their job as they continue to help us hold the line on spending while delivering essential county services. Macon County is indeed fortunate to have such dedicated and devoted employees. The Board earlier this year implemented the new classification and pay plan. Your county employees are very grateful for the Board’s action in bringing our entry level salaries up to minimum recruitment levels and adjusting fair compensation based on the market rate.

Our self funded health insurance program continues to remain strong. We have not increased our rates for employee/dependant coverage in several years due to the fact our claims experience has been favorable. We are not proposing an increase in employee contributions at this time. To do this would sacrifice Macon County’s grandfather status and result in total higher cost for coverage because of tenants of the Affordable Care Act. This will be needing review by January 2014 and adjustments can be considered at that time as a result of full implementation of the Federal Governments Affordable Care Act.

Every year, Macon County strives to improve facilities, provide and maintain services, while we recruit and retain qualified employees. Our goal continues to be improving quality service for citizens and visitors alike. We are committed to maintaining the county’s leadership position in Western North Carolina. Macon County has a reputation of being a forward thinking progressive county that seeks to improve the quality of life while carefully balancing the needs of our citizens and the tax burden they are asked to bear. I believe this proposed county budget reflects that commitment.

A full and complete line item detail has been prepared that gives a thorough breakdown of each expenditure, appropriation and revenue source.

The state is still facing another budget crisis. With the General Assembly still in session we remain concerned that the state could shift additional responsibilities and/or reduce county funding to correct its budget situation. We hope that will not be the case. We have been reassured by our legislators that the state will not balance their budget on the backs of the counties this year. They seem to be trying to hold to that pledge. I remain somewhat optimistic.

Funding for outside agencies in the Special Appropriations budget remains at current year levels.

The proposed budget for Macon County for Fiscal Year 2013 / 2014 as required by state statute is balanced with revenues and expenditures of $46,643,716 and is hereby submitted for your review and consideration.

Respectfully,

C. Jack Horton

County Manager/ Budget Officer

Here is video of the budget message as delivered by county manager Jack Horton at last night's meeting of the Macon County Commissioners in Highlands, NC. A written copy is below the video for your convenience.

I will embed a copy of the budget here when it becomes available.

I will have the full video of that meeting uploaded by sometime this afternoon.

Macon County Manager's Office • Budget Message

Macon County Board of Commissioners

Chairman: Kevin Corbin

Vice-Chair: Bobby Kuppers

Commissioner: Ronnie Beale

Commissioner: Ron Haven

Commissioner: Jimmy Tate

Gentlemen,

In accordance with the North Carolina Local Government Budget and Fiscal Control Act, I am pleased to present to you the proposed budget for Macon County for fiscal year 2012/2013.

Macon County continues to maintain an enviable position in comparison to many counties in North Carolina. The county remains in sound financial condition, and currently has the lowest ad-valorem property tax rate among all counties in North Carolina (@ 27.9 cents per $100). Our county credit rating this year was raised by Standard and Poor’s from an A to an A+. Our fund balance is stable and allows the county to have reserves in an amount equal to at least three months of operating expenditures. This provides a strong degree of financial security in terms of being prepared for unexpected emergencies or shortfalls in revenue. The healthy fund balance, a conservative approach to budgeting, along with a consistent tax collection rate contributes to Macon County’s favorable Bond Rating.

There are many positive accomplishments the county can be proud of, while at the same time being vigilant in our approach to responsible financial planning. I sincerely believe this is what is meant by being a good steward of public funds. I will take time in this budget message to emphasize both highlights of the current year, and the challenges facing the county next year.

On the revenue side of the budget, growth in the tax base is minimal and although sales taxes have somewhat stabilized they continue to fall short of past years growth experience. We, like everyone continue to hope for a better economy next year.

- During the past year Macon County continued with several major projects and has made considerable progress on these. The following list provides some insight on these very important contributions to the future of Macon County.

- Construction continues on the new K-4 Iotla Valley Elementary School, (Construction Cost) $11,300,000, $118.00 per square foot, financed at a net interest rate to the county of 0.48 %. The debt will retire in 17 years, and the school is on schedule to be completed and occupied by this August.

- Little Tennessee/Cartoogechaye Creek Sewer Interceptor Line: The main line is now operational. When we complete the reuse system at the landfill, the project we will be finished. We expect to finalize by June 30th.

- The Riverbend Road/ Highway 28 North, water project is now complete along with a new 500,000 gallon finished water storage tank (Wilkie Street Tank). Funds to extend new water service to the Swiss Colony subdivision area are available, and we are waiting for the Town of Franklin to acquire the necessary easements and rights of way in order to let the contract on this additional phase of the project.

- The Macon County Airport runway extension project has been completed after nearly 10 years of delays and setbacks. The county in this year’s budget appropriated enough funds ($232,634) to match a new Federal Aviation Administration grant of ($2,093,706) for the rehabilitation and repaving of the airport apron. This project will begin this fiscal year but likely will not be completed until early next fiscal year.

- Renovation is well underway on the new Sherriff’s Office on Palmer Street. We expect to have the work completed by June 30, and hopefully fully occupied by then.

- The Barrett Building renovation is proceeding well and with any luck we should have that project completed this summer. In addition to renovating the top floor, and installing a state of the art communications system for the county’s Emergency 911 Center, a new interior accessible elevator will be installed to make the entire building more ADA compliant and handicap accessible.

- The Business Development Center (Incubator) has suddenly taken off with renewed interest. We have several new businesses that have located there this year and have recently had request for more space. We hope to be able to relocate the DMV Drivers License Office and utilize that space for business development purposes soon.

In order to fund essential county services, meet the county’s debt service obligation on capital projects, and maintain critical needs in education and public safety, we have made decisions and recommendations that prioritize ,and in many cases reduce departmental and agency budget requests this year. There are many worthwhile and commendable projects, programs, and services that have merit and still need to be funded and or implemented, but have not been included in this proposal due to lack of additional revenue.

The original approved general fund budget for this year (2011/2012) was $42,775,263. Due to continuing contracts and additional revenue the current revised budget for this year is $45,788,503. The proposed general fund budget for fiscal year (2012/2013) is $44,275,869.

The proposed budget for (2012/13) is 3.5% more than the (2011/2012) original approved general fund budget, and is 3.3% less than the revised current year general fund budget. The increase is due in large part because of additional appropriations from fund balance not from a growth in general fund revenues. This is basically a no growth budget except for one time expenditures from fund balance reserve.

The county General Fund operating budget is balanced within existing revenues. No property tax increase is requested or recommended. We have reduced requests for capital outlay from our departments and trimmed other expenses where feasible. Our goal over the past four years has been to maintain the current level of service without additional staff. We have been able to do that by leaving non critical positions unfilled throughout county departments. We have asked county staff to take on additional work load with no salary adjustment. We continue to fill only essential positions when they become vacant.

Our county employees have worked hard to do their job without complaint as they continue to help us hold the line on spending while delivering essential county services. Macon County is indeed fortunate to have such dedicated and devoted employees. The Board earlier this year authorized a new classification and pay plan study that is almost ready for presentation. We do not have the financial impact of that study at this time, and therefore have not budgeted anything at this point for implementation of the approved plan. We will continue to work with Springsted (our consultant) on an implementation plan when we receive the final report. At this point the proposed budget contains no salary adjustments.

Our self-funded health insurance program continues to remain strong. We have not had to increase our rates for employees/dependant coverage in four years due to the fact our loss in claims has been favorable. We are not proposing an increase in employee contributions at this time. This will be the fifth consecutive year without an increase. I anticipate that next year (2013/2014) that will definitely change.

Every year, Macon County strives to improve services, recruit and retain quality employees and work to maintain and improve the quality of life for residents and visitors alike. We are committed to maintaining our leadership position in Western North Carolina. Macon County enjoys a reputation of being a forward thinking progressive county that seeks to preserve the quality of life while carefully balancing the needs of our citizens and the tax burden they are asked to bear. I believe this proposed county budget reflects that commitment.

There are several key issues we have addressed as we prepared this spending plan for next year. Here are a few highlights of that plan. A full and complete line item detail has been prepared that gives a thorough breakdown of each expenditure, appropriation and revenue source.

The state is still facing yet another budget crisis next year. With the General Assembly in session we remain concerned that the state could shift additional responsibilities and/or reduce county funding to correct its budget crisis. We hope that will not be the case. We have been reassured by our legislators that the state will not balance their budget on the backs of the counties this year. So far they seem to be holding to that pledge. I remain guardedly optimistic

In the past four years Macon County has made an enormous commitment to our local educational system in terms of capital improvement needs as the following demonstrates.

Capital improvements to East Franklin Elementary School (QZAB)..........$2,000,000

New Intermediate School and expansion to East Franklin..........$20,000,000

Purchase (Owens) property for Mountain View Intermediate..........$2,600,000

Nantahala Renovation (QZAB)..........$1,800,000

Iotla Valley Elementary School Construction..........$13,869,000

Franklin High School Improvements..........$1,321,000

Highlands School Improvements and sports fields..........$938,000

Macon Middle School Air Conditioning..........$80,000

South Macon Access Road..........$88,657

Union Academy roof replacement..........$62,765

____________________________________________________________________

Total County Funded School Capital Projects since 2008..........$42,759,422

We plan to complete the window replacement on the Nantahala School in the coming year. Leftover QZAB funds and a small local appropriation will finish this item that was omitted in the original project due to shortage of funding at that time.

The critical need at this time in our school system is Technology.

The county is well aware that the current situation regarding computer upgrades is far behind where it needs to be. With the elimination of ADM funding for technology by the state, our replacement schedule has grown from a five year replacement schedule to a nine year replacement schedule. In addition to that, in less than two years (2014) the state will require all local School Systems to be able to do assessments, and send end of grade reports electronically to Raleigh. In order to meet this critical need now it will require an estimated $1,500,000 in funding specifically for Information Technology. This budget includes a proposal to seek a low interest (around 1.75%) short term (54 month) loan in order to immediately address this issue. The debt will be paid back in yearly fund balance appropriations. This would not only solve the immediate problem but preserve the county fund balance in case of emergency. The estimated loan payment of $311,829 is included in this proposed budget. If the economy improves the county would reserve the right to retire the debt before the end of the term.

For Current Expense and Debt Service

FY 12-13 Current Exp- CO-Solid Waste- Supplement- Debt Service..........$12,384,421

FY 12-13 Total Macon County General Fund Budget..........$44,275,869

Percent of Total General Fund Budget..........28%

Appropriation as a Percent of Property Taxes..........48.89%

The proposed FY 2012/2013 budget recommends the county appropriation to the School Current Expense budget increase to the FY 2009/2010 level of $6,911,000 and the Capital Outlay Budget be funded at $256,000. With current capital outlay at this level of funding the School System could be able to meet at least some of their current critical capital needs. As noted earlier, county funding addresses the $1,500,000 technology need in the school system. The proposed budget continues to include full funding for the teacher supplement.

Another ongoing concern and high priority is public safety. With this in mind the recommendation in this proposed budget is to replace two four wheel drive ambulances in the EMS Department, and six patrol vehicles in the Sheriff’s Department. This will help Macon County preserve our rotation system and preserve our readiness to be fully prepared and able to respond effectively and efficiently when the need arises.

Funding for outside agencies in the Special Appropriations budget remains at current year levels.

The proposed budget for Macon County for Fiscal Year 2012/2013 as required by state statute is balanced with revenues and expenditures of $44,275,869 and is hereby submitted for your review and consideration.

Respectfully,

C. Jack Horton

County Manager/ Budget Officer

0 comments :

Post a Comment